Like most of my articles, I like to write disclaimers up front. In the spirit of transparency, this is part marketing article, but I also included some interesting insights you have probably never seen before to justify it being one of the better advertorials you have read this year. So if you want to get to the marketing call to action, feel free to skip to the bottom of the article 🙂

One of my all-time favorite measures was to show the hiring manager or HR/business leader that the reason it takes so long to hire people is because the business takes too long to pull the trigger on a hire, and ends up losing great talent.

We all know this feeling. The problem can range from too many people involved in the interview loop (the record I have seen is 17) to hiring managers not clearly defining what they are looking for and thus continually moving the goal posts on the requirements. Or everyone’s favorite response from a hiring manager: “I will know it when I see it, so just keep sending me people.”

Below I want to show you what this problem looks like by some major industries you might recruit in and what this problem looks like by different job families. I will even get real granular and show you a specific example of a high-tech company in Seattle where the business sort of sucks on this metric.

When we created an innovative solution to benchmarking using companies’ ATS data (original article here for context), one of the first metrics I wanted to make sure we included was “recruiter vs. business” (RvB). This way anyone at a glance could see if the challenge with hiring people was a potential business problem or a recruiting and sourcing problem.

The measurement for RvB is simple, and if you don’t currently track it in your own organization, start.

Recruiting (R) = The clock on the metric starts the moment the req is approved, and stops once the candidate is sourced, screened, and submitted to the hiring manager. Some people like to call it a QIA (Qualified, Interested, and Available) candidate.

vs.

Business (B) = The clock starts on their part of the metric the moment the candidate is submitted to the hiring manager, and stops once the candidate accepts the offer.

The following graphs are from the benchmarking tool where we now have over 2.9 million records from over 50 globally diverse companies. I wanted to provide the latest information, so I have looked at 2016 year-to-date data.

Rather than show you a whole bunch of time-to-accept numbers by job families and industries which we all know vary a lot by roles/industries, I thought it would be more interesting to show you the percentage of time the recruiting function and business takes for the RvB metric.

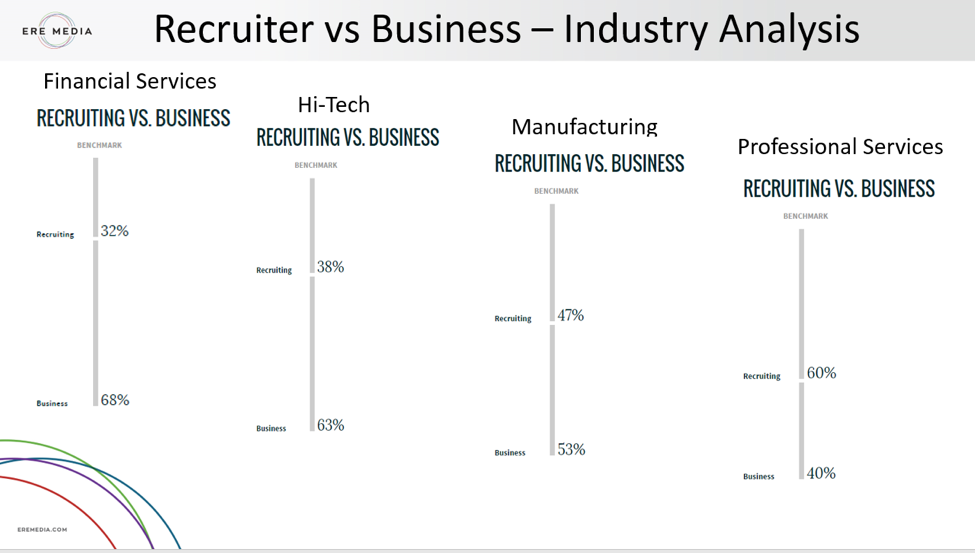

Here is a view of a few industry breakouts …

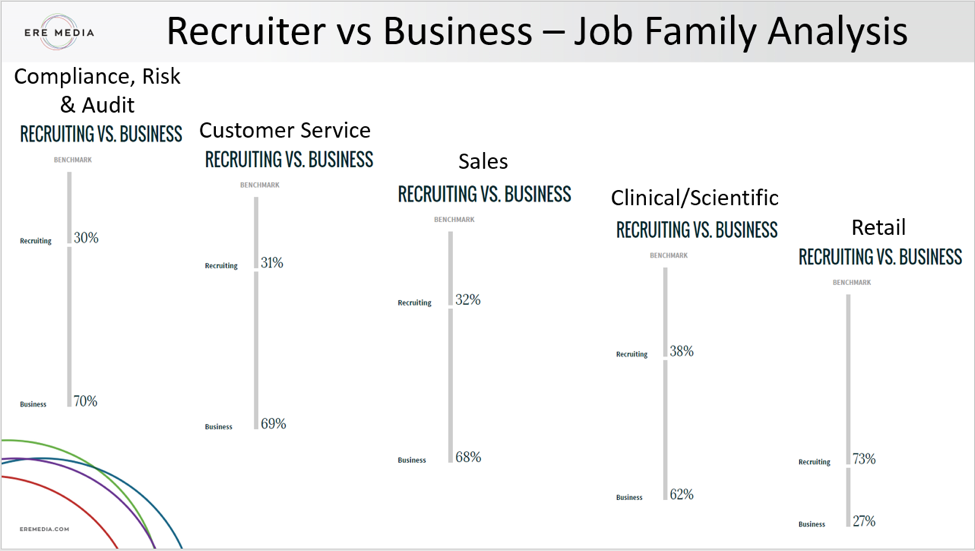

… and RvB breakout analysis by some different job family roles

As you have all experienced, trying to have an emotionally charged conversation with a HR or business leader based on their anecdotal information and feelings on this subject — you are bound to fail. From my many years of dealing with business leaders, the quicker you can ground the conversation in the facts with data to focus the problem, the quicker you will have that business leader come to the conclusion that they might be part of the problem and you’re here to help them come up with a more optimal outcome.

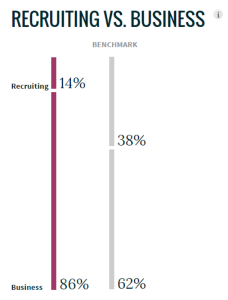

Lastly, here is a specific example of a hi-tech company in Seattle (its data is the purple bar) that will be used to go back to their business leadership with a focused discussion about the challenges and competitive disadvantage it has finding system architects. As you can see in this example below, the recruiting team does a great job of effectively sourcing and submitting candidates, but the business is woefully slow on assessing and making hiring decisions compared to the benchmark for competitors hiring for the same talent (gray bar).

If you are interested in the formula for recruiter vs. business so you can start to use in your own business, or nine other quality, speed, and productivity metrics, you can find all the benchmarking formulas here and you can also get access to the free version of the benchmarking tool here as well.