Should CareerBuilder go public?

Should CareerBuilder go public?

A New York investment banking firm thinks so and suggests that its market value could be as high as $2 billion. In comparison, Monster’s market cap is $3.1 billion at this morning’s opening share price of $24.05.

Evercore analyst Douglas Arthur said the notion of CareerBuilder going public might be considered “far-fetched,” but added, “… one must ask if CB’s full market value is being properly realized?”

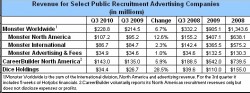

Arthur estimates CareerBuilder’s 2010 EBITDA (earnings before interest, taxes, depreciation, and amortization — a standard method of accounting comparison) to be $132 million this year and $177 million next. Monster is expected to lose money for the year.

How accurate Arthur’s earnings estimates are is questionable. CareerBuilder releases only its North American revenue numbers ($414 million through the end of the third quarter). It says nothing about its expenses or its revenue from operations elsewhere in the world. Estimating revenue and earnings for CareerBuilder is, as Arthur’s report notes, “more art than science.”

How accurate Arthur’s earnings estimates are is questionable. CareerBuilder releases only its North American revenue numbers ($414 million through the end of the third quarter). It says nothing about its expenses or its revenue from operations elsewhere in the world. Estimating revenue and earnings for CareerBuilder is, as Arthur’s report notes, “more art than science.”

Even so, Arthur points out that market values for the publicly traded job sites (Monster, Dice Holdings, and 51Job) has risen a combined 94 percent in the last two months. Monster alone has gone from a low of $10 a share to today’s $24.16.

He also notes that CareerBuilder is the largest job board in the U.S. with 36 percent of the market. Monster has 25 percent (not including HotJobs), Dice has 6 percent, and all the others account for the remaining 34 percent.

Complicating an IPO is CareerBuilder’s fractured ownership. Three newspaper companies — Gannett, Tribune, and McClatchy — own 96 percent, with Microsoft holding 4 percent.

A CareerBuilder spokeswoman says the company has no plans for an IPO, but declined to comment on the financial estimates.

Reposted with permission from ERE.net