Dice Holdings, operator of multiple niche job boards, changes leaders next week, when current CFO Michael Durney takes over as CEO and president.

Chairman, CEO and President Scot Melland steps down Sept. 30 after a dozen years in the top company jobs. He will stay on as a company director.

Both Durney and Melland have overseen the growth of well-known tech career site, Dice.com, into the eponymous public company that today owns niche sites in energy, finance, and healthcare, as well as operating ClearanceJobs.com for jobs requiring security clearances, and tech networking and collaboration site Slashdot and code sharing site SourceForge, among others.

With so much recruiting attention focused on social networking, it’s a challenging time for job boards. LinkedIn has become the darling of the recruiting industry; its stock price soaring to nearly $250 a share, while Monster struggles to keep from falling below $4 a share.

Dice, too, hasn’t been spared the fallout. It’s stock which soared above $18 two years ago, has been trading at less than half that. Yet Durney, who took on operational responsibility for some of Dice’s newest acquisition just over six months ago, is optimistic about the future of the company and job boards generally.

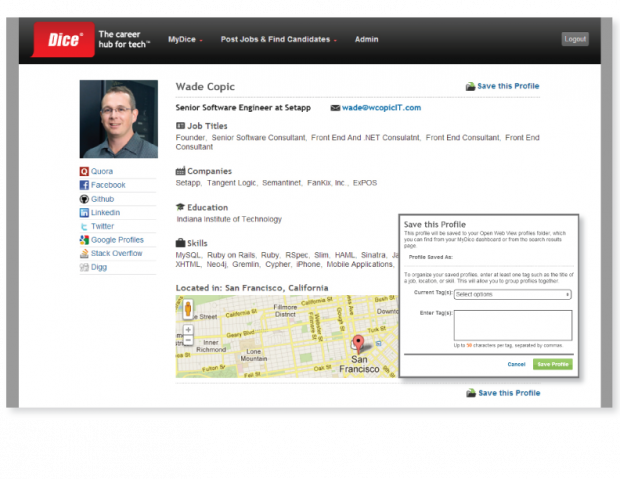

In a Q&A, he credits LinkedIn for helping grow online recruiting budgets, and sees Open Web as a powerful new talent search tool that will be rolling out to much of the Dice family in the coming months.

Here’s our interview with kindergarten and high school dropout (read to the end), and incoming Dice CEO Michael Durney:

Let’s start off with the big picture. At a time when recruiters are turning away from job boards, and more than a few industry leaders are declaring them dead, what do you see as the future for job boards and the commercial career site industry?

I’m optimistic about the industry or I wouldn’t have accepted my latest role. First, LinkedIn deserves a lot of credit for bringing more budget dollars into online recruiting. That’s good for everyone in the long-run and it’s up to us to get a bigger share of that bigger pie. We think we are going to be able to do that with our new sourcing tool, Open Web. We’ve seen recruiters who are embracing Open Web, renew with us at higher rates by count and dollars spent. It’s a good start for a product that is still in beta.

Recruiters report that they are finding unique candidates with Open Web that they can’t find on other services. They love that it’s one search and you’ve compiled relevant candidates from all of the social and professional sites. Finally, they like that its part of the Dice service which delivers candidates through advertising, branding, resumes and social search. It’s a complete way to recruit and the response rates are very high.

Finally, I would say it’s best to ground yourself in facts and recognize that our growth has slowed and we have to get through this transition. But, we are starting our transition from a position of strength. At Dice.com, we have more recruiters and hiring managers under annual contract than we’ve ever had. Dice.com’s revenue per customer is nearly $1,000 a month – a record. So the facts for Dice.com doesn’t show recruiters turning away and we are excited about leading the Open Web future.

Why do you think that; particularly when LinkedIn has surpassed most or all of the job boards in terms of both professional participation and recruitment revenue, and Facebook is also coming on strong in talent acquisition?

We’ve been telling investors for years that LinkedIn would become the leading generalist – so we aren’t surprised at their success and always give them a lot of credit for the clever way they built their profile database. Participation though is an interesting choice of words – once your profile is on LinkedIn – how frequently are those professionals using the site? What are the response rates to inmails? Popularity comes with consequences.

As for us, we’ve always had a very differentiated value proposition against all of the generalists – LinkedIn, Monster, CareerBuilder. We don’t compete head to head with any of them, as they duke it out under the same value proposition – we get better at our verticals, better with Open Web, better at improving response rates, better at driving efficiency. We just play our own game.

I’m not convinced on Facebook as a recruiting platform – it’s a good branding platform, but I think it has a long way to go on the recruiting front. There foray into paid contact is interesting – I think we’ll have to see if there is a better response rate there from candidates. Our research has shown, professionals really do view Facebook as their personal space and aren’t heavily interested in pursuing career information on that platform.

Now, here’s the best part about Open Web – it doesn’t matter where professionals choose to spend their time. It’s software and it is agnostic to whether a professional prefers Twitter or Facebook or MeetUp or Github or some yet to be determined site. We take recruiters to where the information is in a way that they can recruit and contact those professionals directly.

What specific steps will Dice, eFinancialCareers, Rigzone, ClearanceJobs and the others take in the coming months to not only remain relevant, but to grow?

In the coming months, Rigzone and eFinancialCareers will add the OpenWeb technology to their core offerings. Dice is expanding specialized tech recruiting globally anchored by our recent UK acquisition. We are going to focus all of our efforts on improving the efficiency of recruiters and hiring managers to find talent.

For more than a decade DHX has been acquiring assets to support your flagship, and also to diversify into other sectors. Has this been a successful strategy? What are your plans for acquisitions? Will you continue to seek to diversify into other industries?

Acquisitions are still a priority and we will diversify into other industries and potentially tools that make recruiters more efficient. Not all industries will support a vertical player, but there are a handful of interesting vertical opportunities that we’ve mapped a long time ago and just continue to be a patient buyer.

Each of our key acquisitions: ClearanceJobs, eFinancialCareers, Rigzone have all grown tremendously since they were acquired. It’s a double for Rigzone and eFinancialCareers, despite financial services going through two pretty deep crisis since we acquired them. And, ClearanceJobs has gone from $250,000 in revenues on an annual basis to $10 million. We haven’t sacrificed any profitability for that growth – so from my perspective our strategy has been successful for Dice and we’ll continue to pursue it.

Any plans or thoughts of disposing of some of the properties?

No. While we’re always assessing our competitive position in each area, we like being the leader in each of our verticals.

What surprises can we expect in the months ahead?

I think the surprise, may be no surprises. I’ve been a partner in setting the strategic agenda for the company for a long time — so no one should be expecting “big surprising” changes. That said, we are going to take the opportunity to rethink everything we do to make sure that we can deliver more to our customers in an efficient way.

Now, a little about you. Until you joined Dice, your career was in media, and specifically in video and digital media. How does that background influence your vision and plans for Dice?

First, I would say I’ve been here for 13 years, far longer than I worked anywhere else, so a great part of my view of the Company and its prospects is driven by my experiences here. The online recruiting business really blossomed and changed all in the time I’ve been at Dice. As it relates to my prior experiences, I’ve always thought of our business as a form of media, so it fits quite well. And, specifically, I’ve worked in targeted media like Univision and Hallmark Entertainment and others where we competed against bigger, broader competitors – there is definitely a place for providers of targeted content and services.

CFOs tend to be financially cautious, conservative about investments, and, by nature of the job, better at controlling expenses than making sales. How closely does that describe you?

It’s not too accurate – we have a tremendous financial model that allows a lot of flexibility and built in discipline over many years. And, I’m very proud of our finance organization at Dice and how they help their counterparts in sales, marketing, technology, and product think about opportunities.

My role balanced between being the CFO and leading our Rigzone brand and then our Industry Brands Group. I always want to invest if I believe there is going to be a return and that investment will grow our business for the long-term. If anything, I would lean toward being more aggressive.

If you were talking to the head of talent acquisition for a major employer who hires hundreds of workers annually in the sectors DHX serves, what would you say to get their business?

I will demonstrate how our brands fit into their strategy and how efficiently we can put together a slate of actionable candidates to make their recruiters more effective. And, I will follow-up regularly to make sure we are living up to our end of the deal.

Now, if you were talking to a room full of financial analysts (which you no doubt do), what do you tell them to expect in the quarters ahead?

We lay out our financial guidance in a lot of detail, but I’ve told them what I’ve told you: don’t expect any big strategic changes, but I want to see an accelerated pace of improvement internally that will ultimately be reflected in the performance of the company.

What is the most unexpected thing about you that most people don’t know?

I dropped out of kindergarten and high school. While my father was a teacher, we lived in a small town in Turkey for a year and I had a hard time in kindergarten with the language barrier, so I dropped out. And after my junior year of high school, I decided to leave (without a diploma) and start college, which many people don’t realize you can do in New York. I received my high school diploma after a year of college by completing some courses. So, I was a drop out at both ends of the spectrum, but I think I turned out OK. More than anything, this informed my thoughts around following traditional paths which is not necessary and to always be open.